Black Friday, falling on the 29th November 2024, is the annual shopping event known for its deals and discounts. You’ll be hard-pressed to find a retailer that doesn’t get involved with Black Friday in one way or another, and what was once a rush into physical stores, primarily in the US, has become an international, multi-week affair occurring both in stores and online.

Over the past decade, Black Friday trends have shifted and continue to shift as macroenvironmental factors, consumer’s behaviour and consumer preferences change. By looking back at past Black Friday periods, our Insights team has worked to better understand the external factors that influence the event, how ecommerce has transformed Black Friday, and what retailers can do to capitalise on this potentially very lucrative period.

Originating in 1950s USA as a post-Thanksgiving event, Black Friday is now well and truly present in the UK. Retailers have been capitalising on consumer’s recognition of the event for decades now, especially as more US brands entered the UK, dropping prices for a limited time with the aim of getting more customers into stores, and it has evolved significantly within that time.

Black Friday Spending Trends in the UK

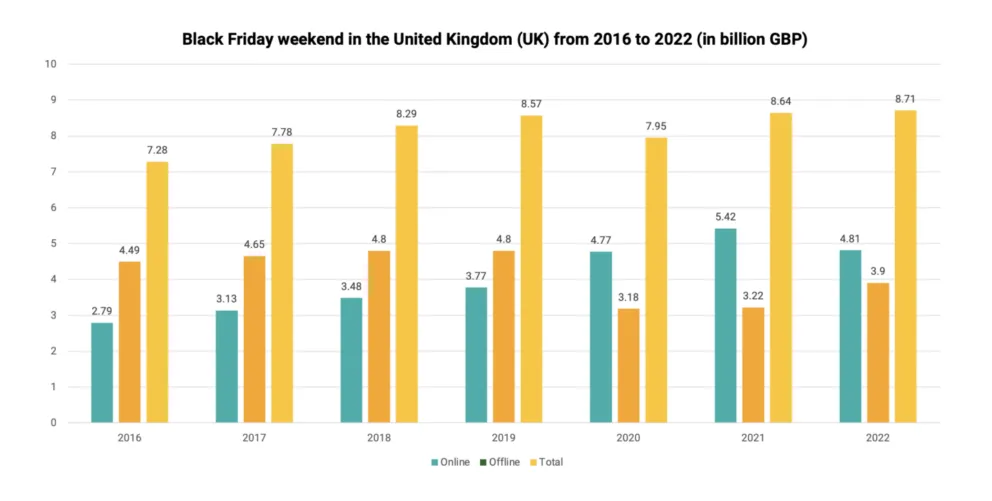

Analysing the available Black Friday spend data in the UK since 2016, the COVID-19 pandemic completely changed the Black Friday game, increasing online consumer spending by a staggering £1.59 billion, whilst offline spend reduced by £1.62 billion simultaneously, effectively inverting consumer spend in the UK between 2019 and 2020.

That gap widened into a cavernous £2.2 billion difference between online and offline spending in 2021, though in-store spending improved in 2022 as the pandemic subsided, stores reopened, and consumer confidence improved.

Source: Statista

Predictions for Black Friday 2023 were mixed, with some suggesting a subtle increase in spend helped by an uptick of in-store spending, whilst others suggested a generalised lack of interest in Black Friday could lower spend. Factor in the UK’s turbulent economic environment at the time, it became challenging to predict how consumers would behave.

It emerged that as the Black Friday week concluded, 20th November to 27th November 2023, revenue performance was down -1.9% year-on-year according to the IMRG, supporting a lack of interest and the influence of economic turbulence.

Black Friday 2024 is also shaping up to be unpredictable, with consumers cutting non-essential expenditure as the cost of living remains high, in spite of a better-than-expected first half of 2024 for the economy. There’s also pointers to suggest that 2024 will finish more positively than it started, which could assist consumer spending if we see a notable rise in consumer sentiment. Consumers seeking deals even earlier than prior years is also on the cards, distributing their spending across pay cycles, further ahead of the festive season.

Despite an unpredictable outlook, we can still apply learnings that have put businesses in a position to make the most of the period previously.

What Influences Black Friday Spending?

1. Consumer Confidence

One of the most significant influences on Black Friday spending is consumer confidence. How optimistic consumers feel about their expected financial situation, which can encompass how confidence consumers are to spend, the amount of disposable income they have, and how considerate they are of present and future economic conditions, all factor into how ready consumers are to spend come Black Friday.

We can see this in the case of the COVID-19 pandemic, where whilst the split of offline and online spending changed dramatically, overall spend also reduced, coinciding with a particularly low period of consumer confidence. Black Friday spending figures can often be considered as an indicator of the general economic health of a country at the time, so if Black Friday spending increases or reduces, there’s a good chance that the economic health of a country has followed a similar trend.

The UK government’s autumn budget also typically falls in late-October, ahead of Black Friday, which can heavily influence economic outlook. With the UK currently facing more favourable economic conditions than 2023, yet consumers remaining hesitant when it comes to spending, consumer confidence will be a considerable factor going into Black Friday 2024.

2. Market Interest

Interest in the event itself is another key influence on consumer spending during Black Friday, partially linked to consumer confidence, but affected by how consumers feel about the event in isolation.

PwC noted that interest in Black Friday dropped last year, from 61% in 2022 to 44% in 2023 overall, something that was considered when giving their mixed outlook for 2023. Various factors can affect interest, including changing priorities for different demographic groups, a lack of new product releases in popular categories and a general lack of disposable income, but how special or unique the event is made to feel is also a likely contributor.

If retailers are noticing a drop-off in customers, something common during a period of economic downturn much like late-2023, announcing and running promotional events more frequently can be a great way to encourage more footfall and manage inventory. Yet if retailers run more promotional events outside of the Black Friday period, this could diminish the impact of Black Friday. If the deals that customers can get no longer feel as elusive, and spending is being encouraged outside of Black Friday, what sets the event apart from any other sale? This is where a cohesive and clear marketing strategy is a necessity, helping to maximise the return on Black Friday for businesses.

How to Effectively Capitalise on Black Friday in 2024

Start Early

Now that Black Friday has evolved, it’s clear that consumers have come to expect not just a long weekend sale, but an extended event spanning days or even weeks, inclusive of a build-up to the Friday itself. This means that starting early, towards the beginning of November even, can be advantageous, though keep margins in mind. It’s crucial to balance the length of a sale against making it worthwhile and profitable over business as usual.

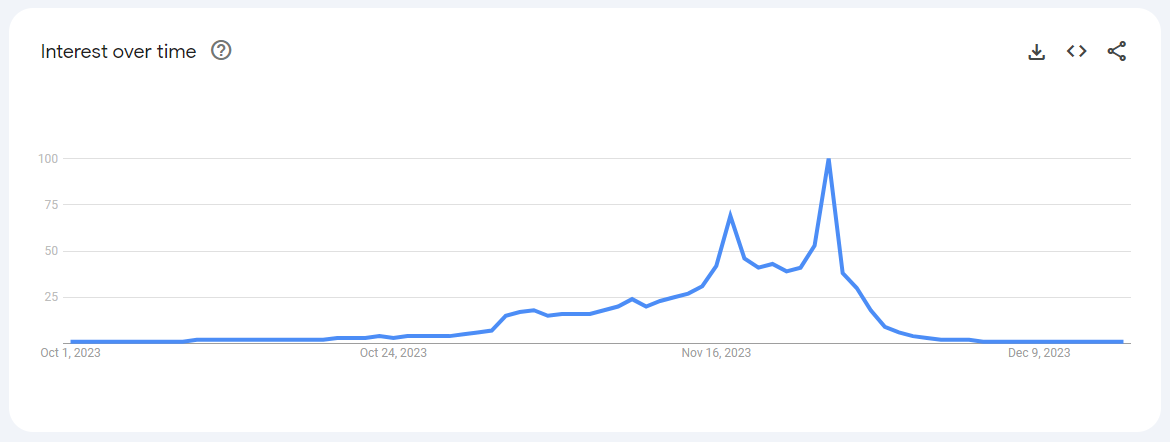

As Google Trends shows, the lines that determine when “Black Friday” officially starts and ends are blurred, with interest in Black Friday rising well before the big day.

November is a stronger month for consumer spending irrespective of Black Friday, with other events and in the run-up to the festive period, so kickstarting marketing campaigns early can build excitement and anticipation.

Specifying when a Black Friday event is happening and for how long works to not only reinforce the benefits above but cultivates a fear of missing out (FOMO), that the discounts available during Black Friday are limited and won’t be available for long. It’s important to consider the content you distribute to your audience when doing this though, and evaluate the risk that customers may hold back spending if they know a discount is coming. Strategies like early-access deals that require a value exchange, such as an email sign up, or spend-now, save-later promotions, could mitigate that risk.

Remember to be creative when conveying this message to make Black Friday feel unique and worth paying attention too, something particularly important in 2024 following a period of economic uncertainty, consumers cutting non-essential expenditure and dwindling market interest.

Optimise Inventory

Optimising inventory and understanding how seasonal changes may have influenced what a business has available to sell is an important consideration. There needs to be enough best-selling products available for customers to buy, meeting demand. Effectively and accurately measuring ecommerce performance is essential, identifying which products are desired the most by customers.

For a clothing retailer, the UK’s warmer autumn period may mean it has more summer-centric clothing stock available, so it may be able to use Black Friday to shift it, and it could get creative with how to encourage that.

Bundle offers are another option for regulating stock levels, encouraging multiple purchases of relevant items. Bundling together Christmas gifts from a single retailer, or outfits from a clothing retailer, are two such examples that could increase the quantity of items that customers purchase.

Consider Communication

How a brand communicates, the message conveyed, the material distributed to audiences and the journey users are sent on, is crucial to making the most of Black Friday. As above, users within a mailing list, seeing an ad on social media or viewing a website need to know that a Black Friday event is happening, that the discounts will be available for a limited time, and that those discounts are unique, setting them apart from those available during other sale events.

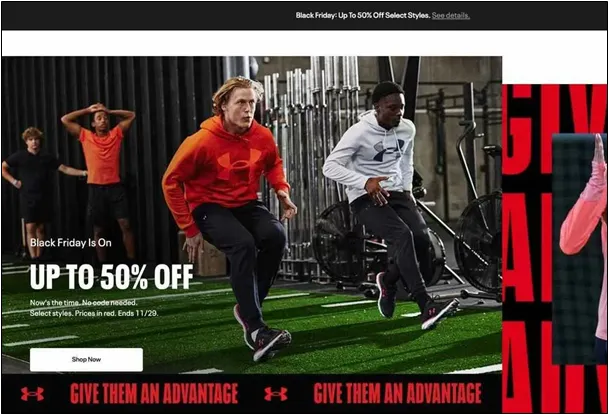

Under Armour letting website users know that “Now’s the time”, that no code is required, what to look out for, and when their Black Friday event ends.

Reengaging loyal customers via a mailing list or dynamic remarketing can be very effective, prioritising those that already have a history of engaging, potentially offering exclusive deals or additional discount codes as incentives. Creating a sense of urgency or anticipation can bolster this too.

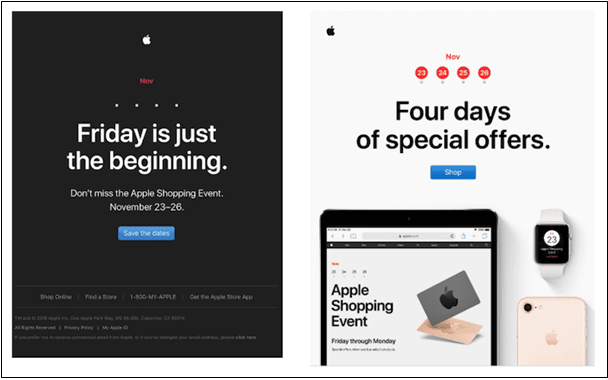

Apple reengaging their mailing list, showcasing multi-day “Apple Shopping Event”, with the ability to save dates.

Need support this Black Friday?

With our advertising and analytics expertise, we can help you make the most of Black Friday with effective, engaging advertising, and accurate ecommerce measurement.

Get in touch to find out more.